Canon launches end-to-end printing smart suite

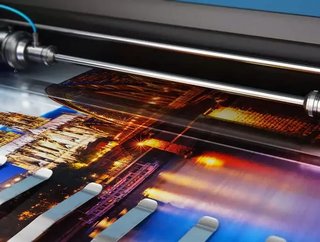

Canon Solution America, a wholly owned subsidiary of Canon USA, announced this week the launch of its new end-to-end solution aimed at increasing efficiency in printing organisations. The Book Smart Suite is aimed at increasing both time and costing efficiencies for printers, using automated workflow, press, media, and finishing solutions along the whole supply chain.

"With Book Smart Suite, Canon Solutions America allows customers to connect the entire digital book manufacturing process from pre-press to print to finishing," said Marco Boer, Vice President, IT Strategies.

"It offers a more efficient way to deploy and maintain end-to-end digital book manufacturing workflow than individual book manufacturers could develop on their own."

The suite will allow manufacturers to reduce inventory size, move product to market faster and keep backlisted titles available. According to the company, “In the past, it was a challenge to match the quality of offset, but advancements in production digital technology mean that Canon Solutions America's high-speed digital solutions offer unparalleled speed and efficient supply chain management — without sacrificing quality. Now, these solutions are offered together in one easy-to-implement, end-to-end suite, taking the guesswork out of the transition to an automated book solution for printers and book manufacturers.”

SEE ALSO:

-

Exclusive from Maginus: Consumer choice and control in delivery is the future for eCommerce

-

RunSafe Security exclusive: Cyber security in the supply chain

For publishers, the Book Smart Suite offers a way to efficiently create short-run and customized content, opening up new possibilities for education materials, trade books, cookbooks, and more.

"For book manufacturers looking to grow and scale, as well as commercial printers who see the revenue opportunity in the book market, the Book Smart Suite is the total package," said Francis McMahon, Executive Vice President, Production Print Solutions, Canon Solutions America. "Canon Solutions America is pleased to offer not only a true end-to-end automated solution but also the most robust product portfolio on the market — and the only production inkjet sheet-fed option for book printing."