HyperloopTT announces multi-million-dollar logistics hub in Brazil

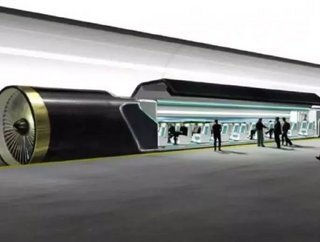

Hyperloop Transportation Technologies has announced its HyperloopTT's XO Square as part of a new multi-million-dollar agreement with Brazil in Contagem, Minas Gerais.

XO Square will house the company's new HyperloopTT logistic research division, a fabrication lab, and an ecosystem of leading global companies, startups, universities, innovators, scientists, and governments from all around the world focused on solving growing issues in logistics.

The agreement was made through a public-private partnership (PPP) with an investment of approximately $7.85mn in its first phase, which includes contributions from HyperloopTT, the Secretariat of Economic Development, Science, Technology and Higher Education (SEDECTES), and private investors.

In addition, the physical space of 5.4 acres and 43,000 square feet of constructed space has been provided by the Municipality of Contagem.

SEE ALSO:

“The State of Minas Gerais, and the municipality of Contagem in particular, are one of the most significant logistics distribution hubs for Brazil,” said Bibop Gresta, Chairman of HyperloopTT.

“With a strategic geographic position, a high concentration of large industries, and a dedication to innovation, it is an ideal location for HyperloopTT's XO Square.”

Dirk Ahlborn, CEO of HyperloopTT, said: “Our objective is to connect large companies and startups, generating businesses and smart solutions for different areas. Knowing that Minas Gerais will host HyperloopTT's research center, means that we are contributing with the State's economic growth throughout different paths, such as science, technology and innovation.