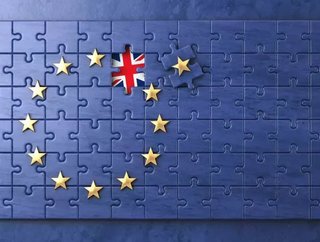

Analysis - what impact will Brexit have on supply chain operations?

Brexit is a great uncertainty for businesses operating cross-border. Therefore, it is crucial for companies operating complex supply chains to consider the implications of Brexit on their businesses.

A PESTLE is an analysis tool that provides an understanding of the factors and external changes to the business, which may impact their ability to operate and thrive.

In this article, Nicholas Hallam considers the elements of Brexit that are out of the control and influence of businesses, but which they should still be planning for, as well as the proactive steps they can take to guide strategic decision making.

Political

Brexit has been an intensely political issue – from the original promise of the In/Out referendum (made by David Cameron to prevent a haemorrhaging of Tory support to UKIP) right through to the political and legal disputes about the triggering of Article 50 and the ongoing controversy about the trade-off between free movement and the single market. The debate - which cuts across traditional political alignments – pits sovereignty against efficiency, and the citizens of definite somewhere against free-flowing globalists.

Now that the we are within the 2-year transition period during which the negotiations have begun to take place, thoughts are turning to the free trade agreements that will need to put in place if the UK is to compensate for the likely loss of trade in the event of leaving the single market. Yet businesses themselves can't control these deals; they are deals that only the UK government and EU and non-EU trading partner officials can strike.

To complicate matters still further, the UK’s major political parties are completely divided about the type of Brexit that ought to be negotiated. Neither the Conservative or Labour parties are clear about whether boosting prosperity or restricting immigration ought to be the priority; and, in this confusion, they probably reflect the country’s general state of mind.

Economic

The UK runs a constant trade deficit with the EU. While the UK's biggest individual export trade partner is the US, over 62% of all exports went to the 27 EU Member States during Q1 2017, totalling £33.1 billion. And during this time-period the UK's top import partner was also an EU Member State, Germany (£17.6 billion worth of goods).

Within the EU, the UK exports most of its goods and services to just a handful of countries – Germany, France, Ireland and the Netherlands. This is partly because:

- France and Germany are large economies and geographically close to the UK

- Germany is an EU manufacturing hub that uses UK components

- There are historical trade links with Ireland, and a common language

- The Netherlands is a global gateway, via the port of Rotterdam, that acts as an intermediate destination for trade between the UK and other countries. It’s also an important financial and business services trading centre.

However, trade prices continue to be affected by sterling movement and the currency market does not favour uncertainty. This may lead to changes in the existing patterns of business we are seeing.

Essentially, the UK's economy is very dependent on its relationship with the EU, and depending on what trade agreements are put in place during the divorce proceedings, British businesses will be hugely impacted by the UK's decision to leave the EU. A lot of questions hang in the balance, awaiting the fall out of the inconclusive May 2017 election result. Will the UK government fight to stay in the single market? Will they want to stay part of the EEA? No one is sure on what the answer will be but the longer it remains uncertain, the greater the risk and worry for businesses.

Social

While Brexit essentially means untangling the links that the UK has with the EU, there are many ways in which we will stay connected irreversibly. Some of the biggest technological advances in recent years - such as smart phones and social media - have been made to connect people no matter their location, language or economic status. So, while the government may have a protectionist ethos, it may be increasingly impractical to implement to live up to most people's expectations and habits.

There is also increasing pressure for the government to protect the rights of EU nationals to remain in the UK post-Brexit (the EU have already indicated that the UK’s first offer is not up to the standard they expect), for the EU to agree to the same for UK nationals living abroad, and to ensure that the jobs market (public sector jobs particularly) don’t suffer because of the restrictions to freedom of movement.

Technological

When considering technology in relationship to businesses and supply chains, one of the newest and most controversial updates in recent years is VAT MOSS, which made changes to the place of supply and the collection of VAT for suppliers of B2C telecoms, broadcasting and electronic services.

These types of businesses are now not required to have multiple VAT registrations, but rather have a single VAT registration in the Member State of establishment through which they collect VAT at the applicable rate of each country and declare via MOSS online. A single payment is also made through the system and this is then remitted to the relevant Member States.

Many of the businesses using this system are based in the UK and hence other EU Member States are enjoying tax revenues on the back of HMRC collecting it for them. If this comes to a stop after Brexit it won’t just be an inconvenience for businesses who will need to change declaration measures but also other tax authorities who will lose use of a system already delivering effective and efficient tax collection.

The increasing importance of Blockchain also creates an interesting context for businesses post-Brexit. Essentially, blockchain allows transactions to take place without the need for a third-party intermediary to become involved, by allowing secure peer-to-peer validation. The most well-known example of a blockchain is Bitcoin – a digital currency that is transacted securely and without the need for a bank.

First, when considering blockchain transactions, there is a need to determine whether these types of transactions are liable to VAT. The EU decided, with regard to Bitcoin, that, as a currency, Bitcoin is exempt from VAT, but it is the process rather than the decision that highlights the issues with blockchain. Technology development is fast paced and unforecastable. Member States, and the EU itself, will not be able to foresee the developments until they are already in use by people and businesses, by which point they must catch up and decide how these transactions should individually be treated.

When the UK leaves the EU, they will have the ability to decide for itself how to treat blockchain transactions, which may put them at odds with the treatment that the EU has determined, leading to a distortion of competition between UK businesses and EU companies.

Moreover, the introduction of blockchain could infinitely change the way that businesses transact and manage their supply chains, as well as the way that tax authorities monitor businesses and collect tax in the future. The possibilities are endless.

Legal

While many business owners and directors are waiting for the facts to emerge from the negotiations, believing that in reality Brexit is still a long way off (the Institute of Export's recent survey found that only 30% of respondents have any strategy for avoiding the risks involved with customs compliance), if you're in the business of planning a supply chain, decisions need to be made now.

Currently the UK has the lowest examination rate at its ports of any EU country, but in the wake of Brexit businesses will have to start proving everything and will not be able to take anything for granted. The regulatory burden on businesses will rise, compliance checks will increase, applying for the correct documentation/licenses will take longer (and the need to coordinate these with your shipments) and the rules of origin will have to be considered.

Therefore, high frequency importers and exporters will be most affected, but all businesses can run some basic checks to make sure their freight forwarder or hauler is prepared for Brexit. Do they have plans in place for after Brexit? Will they be offering duty deferment after Brexit or will they instead be asking for payments up front?

Environmental

In an ideal world, the customs clearance process would look the same as now but this is not guaranteed. The Guardian recently reported that we can expect a "five-fold rise in customs checks" at UK ports after Brexit and that HMRC estimates that the number of customs declarations at Dover and elsewhere could rise from 60m a year to 300m a year.

This increased compliance will stretch facilities at ports, such as Dover, because more vehicles will have to be stopped (currently only about 3% are subject to checks for paperwork because the lorries are from outside the EU). Yet there is no room for the Port of Dover to expand due to it being sandwiched between land marked as an Area of Outstanding Beauty and a motorway.

There have been suggestions that these customs checks may take place in land, after going through the port, but a location or system to ensure that lorries maintain compliance has yet to be suggested or determined.

The Road Haulage Association (RHA) states that approximately 30% of all food consumed in the UK come from the EU, transported in trucks. The extra time to be processed and cleared through customs will have to be factored in, especially when considering the short lifespan of food, to ensure that the goods are able to get to market in time.

- The Home Depot is Enhancing CX thanks to Google CloudTechnology

- Top 10: Women in Supply Chain and Procurement in APACProcurement

- Dumarey Streamlines Suppliers with BearingPoint and JAGGAERSupplier Relationship Management (SRM)

- Explained: What is the SBTi’s Land Transport Guidance?Sustainability