Accenture and MIT: Stress Testing Supply Chain Resilience

Accenture and the Massachusetts Institute of Technology (MIT) are currently co-developing a supply chain resilience stress test that will allow analysts and supply chain specialists to assess the operational and financial risks created by major market disruptions, disasters or other catastrophic events. The industry-leading institutions drew inspiration from the financial services industry stress tests that were crucial, and even made compulsory, after the 2008 Global Financial Crisis (GFC).

The joint effort aspires to create a global industry standard for a data-driven strategic assessment of supply chain resilience.

“The COVID-19 pandemic exposed considerable weaknesses, resulting in severe disruptions in supply chains around the globe, shedding light on the need for intelligent supply chains that prioritise transparency, anticipate new risks and enable faster decision-making,” said Kris Timmermans, senior managing director and Accenture’s global supply chain & operations lead. “Our stress test enables companies to run more than 40 scenarios at one time, providing unprecedented visibility into where and how their supply chains will be impacted during a major disruption.”

Combining Capabilities

Leveraging Accenture’s expertise in supply chain, operations and analytics, and MIT’s research and capabilities in data science, the stress test will quantify supply chain resilience in a single resilience index. According to Accenture, with this test organisations will be able to identify potential points of failure in their supply chain, assess their related financial exposure, and define appropriate mitigation strategies and actions. Because the scenarios are standardised, organizations both in the public and private sector will also be able to benchmark their resilience against peers and competitors across industries.

The global food company, Sigma, through its European subsidiary Campofrio, is among the companies working with Accenture and MIT to implement the stress test on its supply chain and provide input and use-case insights to its development.

“As a company with a wide international footprint, we need to ensure an uninterrupted supply of products to our customers, no matter what disruptions occur. Managing the impact of COVID-19 required high effort on our side, and in the process, we uncovered several weaknesses in the supply chain we wished we had identified more proactively before,” said Fernando Ibarra, Supply Chain Director of Sigma in Europe. “Working with Accenture and MIT on this groundbreaking project will be key to recognise other potential weaknesses and continue increasing our supply chain resilience.”

How To Run It?

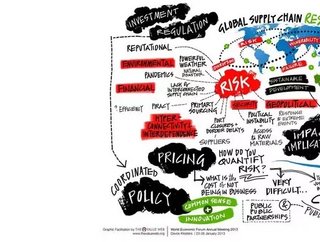

The stress test begins with the creation of a “digital twin” of an organisation’s supply chain. This enables the subsequent modelling of various combinations of scenarios and impact that would significantly disrupt the organisation’s ability to serve customers, shareholders, employees, and society. Such scenarios could include sudden spikes or drops in demand, the shutdown of a major supplier or facility, scarcity of critical raw material, or disruption of a key port. The stress test can identify both the time it would take for a particular node in the supply chain to be restored to full functionality after a disruption (i.e., “time to recover”) and the maximum duration the supply chain can match supply with demand after a disruption (i.e., “time to survive”). This approach to supply chain risk management has been introduced and discussed by MIT Professor David Simchi-Levi and his PhD students in their article, “From Superstorms to Factory Fires: Managing Unpredictable Supply-Chain Disruptions.”

“There is a critical need for a global stress test standard to help prevent shortages of vital products and supplies from happening when the next disaster strikes,” said Simchi-Levi, who has published extensively on the need for consistent approaches for identifying and mitigating supply chain risks (see “We Need a Stress Test for Critical Supply Chains, and Identifying Risks and Mitigating Disruptions in the Automotive Supply Chain”). “The test will allow companies to understand the resiliency of their supply chains, recognise weak links and act quickly to balance the impact of unprecedented events on customers, operations and finances.”