Slowing freight & manufacturing signals recession - Reuters

Global freight volumes have begun to fall as overall consumer and business spending slows, says a Reuters report, which also shows a post-pandemic swing away from merchandise and towards services – a trend that could prolong recession.

The report is authored by John Kemp, a senior market analyst at Reuters, who specialises in oil and energy systems. In it, he publishes selected indicators on global freight and manufacturing production.

It shows that slower growth in freight and manufacturing is set to ease pressure on supply chains and commodity markets, taking some heat out of rampant inflation.

Kemp says the slowdown is “a necessary part of the rebalancing process after exceptionally rapid growth in merchandise trade and output in the second half of 2020 and throughout 2021”.

But he adds that it also threatens to spill over into the services sector, and that this will turn a mild economic slowdown into a more prolonged affair.

Kemp says: “Most measures of container freight and manufacturing activity reached a cyclical peak in the final quarter of 2021 and have been gently declining since then.”

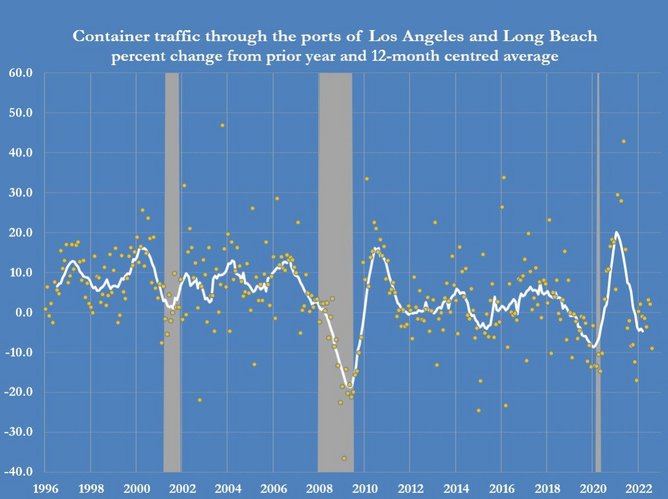

LA container shipping volumes down by 1.5%

The report cites maritime container volumes handled by the southern California ports of Los Angeles and Long Beach, which from June to August was down by 1.5% compared with 2021.

Container freight through the port of Singapore, meanwhile, was below prior-year levels in seven of the ten months between December 2021 and September 2022.

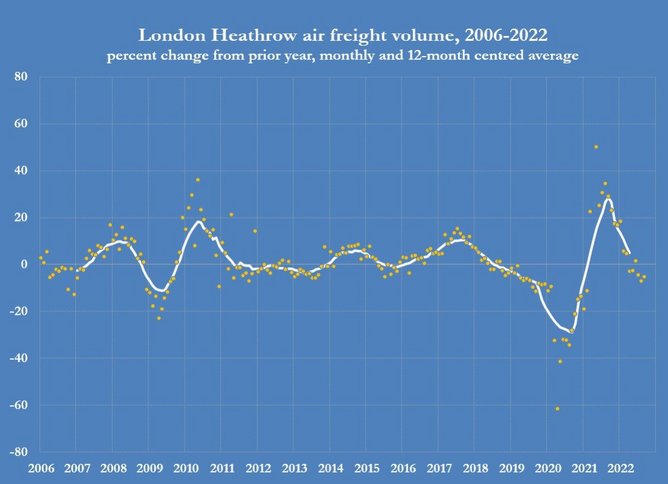

Kemp also says air cargo through London Heathrow was below prior-year levels in five of the six months between April and August 2022, and that at Tokyo’s Narita airport it was below prior-year levels every month between March and August 2022.

The slowdown in maritime cargo has caused container shipping lines to cancel sailings to reduce capacity and limit downward pressure on freight rates.

Even so, China’s container shipping index, a composite measure of the cost of sending cargo by sea, has fallen by 43% since the end of January, though costs are still more than double compared with October 2019, before the pandemic.

The slowdown will gradually unblock supply chains and ease some of the intense upward pressure on merchandise prices that has occurred since mid-2020.

Manufacturing left with inventory headache

Kemp’s report also covers manufacturing. In late 2021 and early 2022, he says manufacturers and distributors over-ordered raw materials, semi-finished items and finished products to avoid a repeat of last year’s supply disruptions.

But this, he explains, has left them with excess inventories, causing them to cut new orders, after household and business spending on merchandise slowed in 2022.

He says manufacturing production has started to fall in many of the advanced economies:

- Germany’s industrial output was down 2% in the three months between June and August compared with the three months from December 2021 to February 2022.

- Eurozone manufacturers reported lower business activity in each of the three months from July to September, according to purchasing managers’ surveys.

- US manufacturing activity has been flat since March, according to estimates produced by the Federal Reserve.

And according to the Institute for Supply Management, US manufacturers also reported new orders fell in three of the four months between June and September.

As growth in output, employment and incomes slow in advanced economies, demand for their merchandise will also fall away in the remainder of 2022 and well into 2023, says Kemp, who points out that the forecast growth in world merchandise trade volumes next year would be among the slowest rates in the past 40 years.

Kemp’s findings echo those in a similar report, from supplier financing specialist, Tradeshift.