Supply chain disruption a top fear for retail & CPG execs

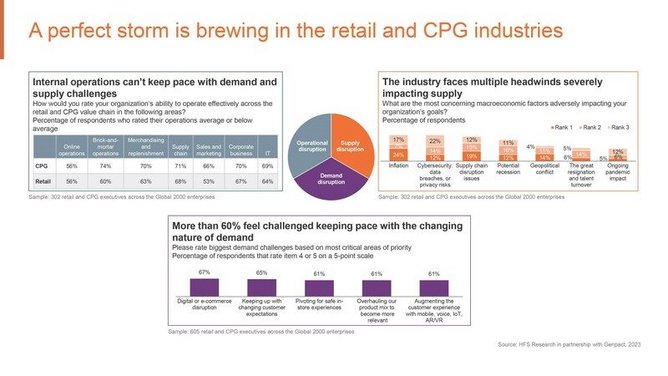

Supply chain disruption is one of the top fears among retail and consumer packaged goods (CPG) executives, research shows.

The joint study – from professional services firm Genpact and research organisation HFS – reveals that companies can't keep pace with supply challenges, with just 22% feeling they have successfully modernised order-management operations.

The research also highlights the need for organisations to transform supply chain processes and operations to meet ever-evolving consumer needs.

Pandemic-fuelled supply chain disruption is something that 70% of retail and CPG executives are still struggling to cope with, the study shows, with inflation and cybersecurity being among the other top concerns.

The pandemic and other supply chain shocks are also changing the shape of supply, with 75% saying their companies are transitioning from traditional linear supply chains to autonomous supply networks.

Changing consumers expectations are reshaping business models

Growing consumer expectation and e-commerce are other factors reshaping business models and digital initiatives, the study shows.

The report – built from 600 responses from global retail and CPG executives – also carries advice for businesses looking to modernise and transform in the face of market pressures.

Looking ahead at enterprise challenges, leaders must align priorities and investments across the three Horizons of innovation and value creation to survive, thrive, and lead. Yet, the study shows that only 6% of retail and CPG companies executives say their companies are investing across the three Horizons and focused on all the right initiatives to lead in the future.

"Retail and CPG companies struggle to balance the macroeconomic 'slowdown' with the 'big hurry' to innovate," commented Saurabh Gupta, President, Research and Advisory Services at HFS Research. "Most companies are not investing across all the areas they need to meet. Beyond survival, they must take a balanced approach to their people, processes, sustainability initiatives, and technology to thrive."

Customer evolving buying patterns also driving new channels, the report also found, with another pandemic trend the rapid rise of direct-to-consumer (DTC) sales. As a result, over 70% of consumer-packaged goods executives said that their companies are investing in DTC models for growth.

Sustainability meanwhile is mission critical, but improvements are still needed. Just 60% of retail and CPG executives told researchers their companies had appointed a Chief Sustainability Officer, developed frameworks for front-line employees to be more aware of their impact on the planet/sustainability, and had engaged a third-party services provider to help achieve sustainability goals.

"The pace will only pick up, especially with the explosion of generative AI," said BK Kalra, Global Leader of Retail and Consumer Goods at Genpact. "Our research underscores that companies need to transform their operations, invest in AI and data, and develop new business models in a digital-first world."